There are two key aspects used to determine how long your retirement funds will last. The first is how much you plan on spending in retirement and therefore the amount you will need to withdraw from your retirement savings to fund those expenditures. The second piece is how much the retirement funds will earn while you are in retirement. The investment strategy is what will determine how much your portfolio earns. Please keep in mind that there are many other factors that go into determining these two pieces. For example, if you own your home outright you may be able to spend less since you don’t have a mortgage payment. If you have a large social security check to fall back on you may also be able to take out less each year. When you determine your portfolio earnings, you will want to identify your risk tolerance and the corresponding investment strategy that works best for you. If you have any questions about how to factor in all of the different pieces, talk to a retirement planner.

Now, speaking generally, lets talk about how your spending and the earnings on your retirement funds affect the longevity of the account.

In general, if you withdraw less than what you are earning, your funds will last forever. However, due to inflation in the cost of living, we assume that you will need to withdraw slightly more each year. If you withdraw more than you are earning, at some point you will deplete your assets.

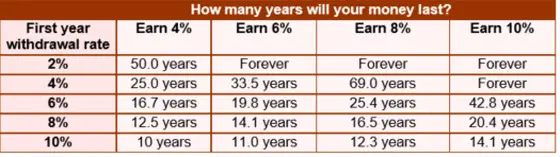

Following is a chart showing how many years your money will last at different withdrawal rates and different earnings rates. The chart assumes that the level of withdrawals increases at 4% per year (to cover increasing costs of living) and shows how long your money will last at different rates of return on your money.

For example, let’s assume you have accumulated $250,000 when you retire at age 65. If you start withdrawing 10% ($25,000) per year, assuming your withdrawals increase at 4% per year (a good guess for inflation) and you earn 4% on your money, you will run out of money at the end of ten years. Even if you earn 8%, the money will be depleted just after the twelfth year.

Using the information in this chart can help give you a better understanding of what it will take to afford a financially secure retirement. Just remember that this is not the whole picture.

There are two common sense (yet important) messages to learn from this chart:

- Once you start withdrawing money from what you have accumulated, the rate at which you withdraw is more important than the earnings rate. Its also easier to control.

- The more you accumulate and therefore the smaller portion you will need to withdraw each year, the longer your money will last.